PROPERTY TAXES

2025 Property Tax information will be available November 1, 2025

- Click the PROPERLY VIEW TAX BILL LOOKUP system (HERE, or the Icon) to access the system and lookup your tax bill.

The Crittenden County Sheriff’s Office, as established in Kentucky law by KRS 134.140 and 160.500, is the collector of all state, county, school, and district taxes that are derived from assessed real, tangible, and intangible properties. The office is then responsible for the distribution of tax collections to the appropriate taxing authority or jurisdiction. We collect approximately four million in taxes each year.

Property taxes are to be paid in person or by mail at the Crittenden County Sheriff’s office located at:

200 Industrial Drive, Suite D

Marion, KY 42064

FREQUENTLY ASKED QUESTIONS

Q: What are the different amounts on my bill and where does the tax assessment go?

In Kentucky, each Counties Sheriff's Office is in charge of collecting and disbursing the levied real taxes assessed. In Crittenden County, here are the amounts assessed by each taxing district:

KY State: 13.08%

Crittenden County: 13.54%

School: 59.24%

Health Department: 3.44%

Extension Office: 4.59%

Library: 5.74%

Fire Dues:

Fire dues are a flat fee collected on county property tax bills to fund fire protection and first-response from the county’s volunteer fire departments. The $30.00 membership fee is assessed on only one property in the name shown on tax bills. Delinquent fire dues are assessed penalty and interest just like real property taxes. While fire dues are optional, opting out makes the property owner responsible for a minimum charge of $500.00 payable to the home fire department responding to an emergency call. You may opt out by July 15 of each year in the office of the County Treasurer.

911 Fees:

The E-911 Service Fee replaced a monthly fee on landline telephones beginning in 2021. The decrease in the number of landlines created a funding shortfall, leading Crittenden Fiscal Court to enact a $36.00/per residential and commercial Adwelling E-911 Service Fee placed on county tax bills. The E-911 Service Fee is not optional and is not subject to a discount or penalties. After April 15 unpaid E-911 Service Fees are payable in the office of the County Treasurer.

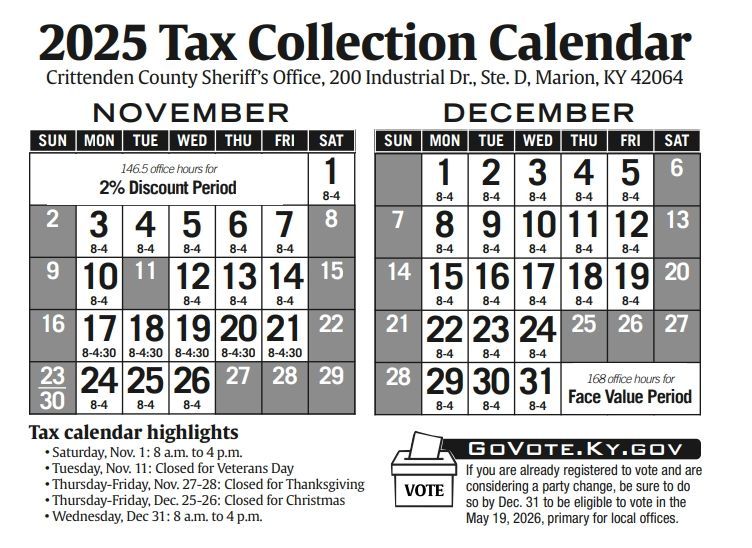

Q: When is my current bill due?

The Sheriff normally receives the tax bills from the County Clerk at the end of September. By statute, we may not accept tax payments prior to this time. Most taxpayers should anticipate receiving their bills mid November. The bill will show five different due dates and payment amounts. For the current tax year, the dates and amounts due are as follows:

Received or postmarked by:

- November 1st - November 30th: 2% discount

- December 1st - December 31: Face Value

- January 1st - January 31st: 5% penalty

- February 1st - April 15th: 21% penalty

- After April 15th the tax bill must be paid at the County Clerk’s Office. Taxes are presumed delinquent after April 15th and extra penalties may apply.

Our office recognizes post office postmarks as evidence of timely payment. Collection dates and penalty amounts are set by statute and approved by the Kentucky Revenue Cabinet; our Office has no authority to negotiate these matters.

Q: What if I haven’t received a tax bill?

If you have not received your tax bill by November 10th, please contact our office and a duplicate bill will be sent to you promptly. You can pay your bill at the Sheriff's Office without a physical copy of your bill... We can look it up.

Q: I thought my bill was sent to my mortgage company. Is it?

No. Bills are sent to the owner of record on January 1st of the taxing year. Mortgage Companies sometimes purchase the tax rolls from PVA getting your tax information. It is your responsibility to make sure your mortgage company gets your bill.

Q: Where and how may I make a payment?

You may mail a check or money order with a copy of your tax bill to our physical address, or you may pay in person at our physical address, or by mail to our mailing address.

If you are mailing your payment, please include a current phone number!

Q: Can I make payments on my tax bill?

Unfortunately, we are unable to accept partial payments on tax bills. If you’re having difficulty paying your bill, make sure you’re receiving any exemptions, such as homestead or disability, to which you may be entitled. It’s also recommended to plan in advance for this annual expense. Although rates and assessments may change from year to year, the amount due is usually similar from one year to the next. If you have a mortgage, you could consider establishing an escrow account with your lender. The mortgage company will then add enough to your monthly mortgage payment to pay your property taxes on your behalf at the end of the year.

Q: May I pay multiple bills with one payment?

Yes.

Q: Will I receive a receipt for my tax payment?

Your cancelled check or money order stub serves as your receipt; however, we will mail you a receipt if you enclose a self-addressed, stamped envelope with your tax payment. If you pay in person at our physical address, we will be glad to provide a receipt at the time you make your payment.

Q: What is the official tax year?

The tax year for our community is a calendar, as opposed to a fiscal, tax year. In other words, the bill that you receive in October represents the taxes you owe for the period beginning January 1st of the current year and ending December 31st of the current year.

Q: What do I do with my tax bill if it is for a house I sold?

Please forward that tax bill to the new owner at your prior address.

Q: To whom do I pay delinquent taxes for prior tax years?

Please contact the Crittenden County Clerk at 270-965-3403 to request a payoff amount for delinquent real property tax bills.

Q: Who pays the taxes on the property that I bought or sold during the year?

Kentucky law requires the tax bill to be issued in the name of the January 1st owner. If the house has been sold or transferred after January 1st, the bill is sent to the person who owned the property on the 1st day of the taxing year. Therefore, a closing agent or attorney will usually calculate and collect the prorated taxes due from each party at closing. In some cases, the agent or attorney will then pay the bill to the Sheriff. In other cases, the buyer or seller may receive a credit on the settlement statement but will then be responsible for paying the bill to the Sheriff. Please check with your closing agent or attorney for instructions on your responsibility. Also note that our office requires payment in full of the tax bill by one or both of the parties; we cannot accept prorated payments.

Q: What are, and to whom do I apply for, Homestead and Disability Exemptions?

These are exemptions that enable you to reduce the taxable assessment (and accordingly your tax bill) of the home that you own and within which you live if you are over the age of 65 or are totally disabled. Please refer any questions regarding these exemptions to the Property Valuation Administrator’s Office at 270-965-4598.